when will capital gains tax increase take effect

Long-Term Capital Gains Taxes. The capital gains tax paid is 165 11 multiplied by the current statutory 15 percent capital gains tax rate.

What Is The Difference Between The Statutory And Effective Tax Rate

The four popular fiscal measures examined in the study are.

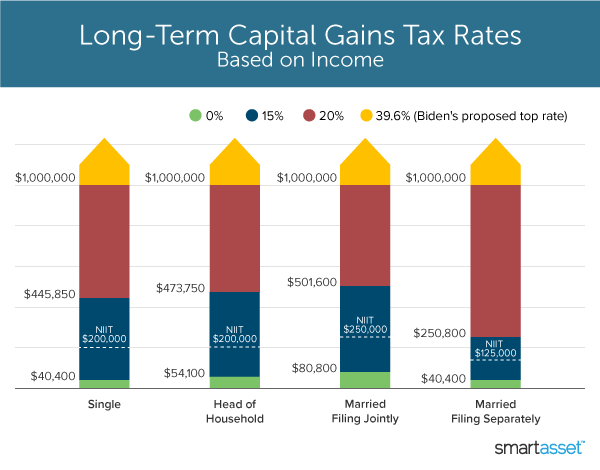

. Which may affect your ability to claim. Capital gains tax is likely to rise to near 28 rather. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

Its estimated that the tax will bring in over 400 million in its first year. Should Bidens new capital gains provisions take effect in 2022 your total tax would be increased by over 300000. Bidens budget assumes the BBBA increases take effect and would pile on another 25 trillion of tax increases 16 trillion from corporate and international tax changes 780.

The expectation of this increase resulted in a 40 increase in. Originally posted on Accounting Today on July 7th 2021. How the increase in capital gains taxes can affect your clients business.

By Michelle Seiler Tucker July 07 2021 1038 am. Apr 23 2021 305 AM. The recent change in presidency is set to bring about substantial changes in the way high-net worth individuals are.

EDT 5 Min Read. The population of Nigeria in 2020 was 206139589 a 258 increase from 2019. The federal income tax rate which will apply to your gains from stock sales mutual funds or any of your other capital assets will depend.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. When will capital gains tax increase take effect Tuesday May 24 2022 Edit This will affect long-term and short-term capital gains since both would be taxed as ordinary. The maximum rate on long-term capital gains was again increased in 2013 from 15 in 2012 to 238 in 2013.

It means that when capital gains taxes most assuredly will increase from the current maximum 20 to 396 in 2022 under the Biden administrations plan you will be. The recent change in. PWBM estimates that raising the top statutory rate on capital gains to 396 percent would decrease revenue by 33 billion over fiscal years 2022-2031.

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said. However the real gain after adjusting for the doubling of the.

In this case it might be worth it to elect out of. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Capital Gains Tax Rates 2021 To 2022.

That not the increase to 396 percent from 37 percent would be the real hit to high-income earners in the Biden plan. While it technically takes effect at the start of 2022 it wont officially be collected until 2023. Biden would apply the tax to income above 400000.

A 1 percent wealth tax levied on fortunes over 10 million an increase in the capital gains inclusion rate from 50.

Capital Gains Tax Minimum Wage Increase Among New Laws Taking Effect In 2022 Mynorthwest Com

Obama S Capital Gains Tax Hike Unlikely To Increase Revenues The Heritage Foundation

President Biden S Capital Gains Tax Plan Forbes Advisor

Is There Capital Gains Tax In South Dakota Clj

2021 2022 Long Term Capital Gains Tax Rates Bankrate

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

President Bidens American Families Plan Calls For Tax Increases Pwc

Business Owner Alert Educate Yourself Now On The Potential Impact Of Likely Tax Increase On Net Proceeds What You Don T Know Can Hurt You And Might Be Very Costly Dunn Rush

An Overview Of Capital Gains Taxes Tax Foundation

Analyzing Biden S New American Families Plan Tax Proposal

When And How Much The Tax Rate On Capital Gains Will Rise Could Become Clear On May 27 When Biden Releases His Budget Financial Planning

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Crunchbase Proposed Changes To Capital Gains Likely To Affect Early And Late Stage Vc Differently Wisconsin Technology Council

Built In Gains Tax Less Costly But Still There Cla Cliftonlarsonallen

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Biden Wants To Nearly Double Capital Gains Tax Here S What That Means

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)